The current paper reviews various instruments of trade policy available at the disposal of the government to influence imports and exports. In the context of growing inclination of many countries towards adopting protectionist policies, the paper describes various methods adopted by modern countries to discourage imports. The first section introduces the need and importance of the topic. The second section illustrates various tariff and non-tariff instruments of trade policy which can be adopted to discourage imports. The last section concludes the paper with a word of caution while using protectionist policies.

Before calculating assessable value you must calculate

the Cost, Insurance and Freight. Enter the cost of goods sold, cost of insurance, cost of freight, and handling charges into the calculator to determine the assessable value. If you look at the above scenarios, we have to pay for multiple parties against a Single Goods Receipt note, but different amounts. There are multiple parties involved in this supply chain from Supplier to Customs to Local logistic agencies to Customer.

When Do Subsidies Result in Countervailing Measures?

If you’re really lucky, the DOC might even reach some kind of suspension agreement on subsidies and countervailing measures. This is when an investigation of the DOC finds dumping or unfair subsidies but manages to make a deal with the exporting country. Antidumping and countervailing duties specific to steel-related commodities currently represent the majority of AD/CVD orders. Of the 662 orders in effect, 305 are for steel-related products. Another 27 steel-related products are currently under investigation. Not every product made with the help of government funds is on the hook for countervailing duty.

Each one has different terms, currency of payments and cost factors. The above calculation of gst i found in the guide give by cbec. My Oracle Support provides customers with access to assessable value calculator over a million knowledge articles and a vibrant support community of peers and Oracle experts. In economics, it’s a version of TAANSTAFL – there ain’t no such thing as a free lunch.

Countervailing duties fall into the same category of import taxes as anti dumping duties. Both work to prevent unfair price competition between imported and domestic products. DHL typically pays duties and taxes to authorities upon import on behalf of the receiver, and then charges the receiver.

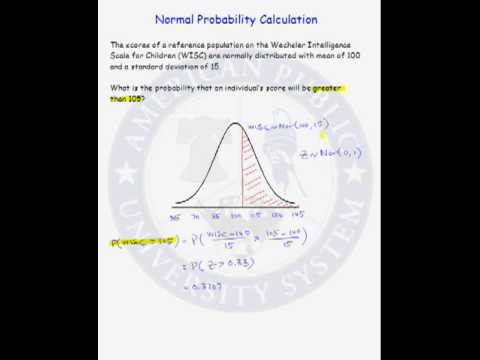

Calculation of Total Tax Incidence

This helps us to value the product and decide on the selling price. Many businesses make loss by not focusing on these small and important factors. Understanding how to calculate countervailing duty and other ins and outs of the importing process can take years of trial and error. Some import laws are very fluid, especially when it comes to tariffs and duties. A countervailing duty is a tax charged on goods imported from a country or exporter that has received government financial aid.

Consumers in the destination country have access to buttons in all shapes, sizes, and so forth. Domestic button manufacturers start creating buttons with greater variety and investing in their factories to improve quality and yield. Custom duty must be calculated on Assessable Value or MRP

(Maximum retail price).

Landed Cost Formula with an example

Now the port of landing is Mumbai, where the Customs would clear the process and release the Machine. Now a day, many Courier companies do these end to end services including Customs clearance too. So you pay them a sum and they will get the product cleared from customs, pay the taxes and deliver the items at your Doorstep. Each country has its own customs laws and the duties for different types of goods and values are set locally. DHL, like any other international transportation company, must adhere to local customs legislation and so DHL pays duties on the receiver’s behalf to clear shipments on arrival. The payment of duties and taxes are typically the responsibility of the receiver.

Looking for ways to keep your supplier information from competitors? An overabundance of product tends to lower the price customers pay. Customers are happy, but businesses selling a similar domestic product will have a tough time demanding high prices. Countervailing duties and antidumping duties are often grouped together.

- This is when an investigation of the DOC finds dumping or unfair subsidies but manages to make a deal with the exporting country.

- One manufacturer’s government assistance check is another importer’s entry fee.

- The product value would be what you paid for the products in the exporting country, not what you sell them for in the U.S.

- My Oracle Support provides customers with access to over a million knowledge articles and a vibrant support community of peers and Oracle experts.

- The assessable value is based on different methods of valuation.

- The customs authorities in the destination country determine whether any duties and taxes are applicable when the parcel arrives.

Customs and Border Protection (CBP) collects the amount as a deposit if and when investigated products are imported. The International Trade Administration’s (ITA) Enforcement and Compliance division calculates the final countervailing duty (CVD) if needed. An exact answer for how to calculate countervailing duty is possible with the right knowledge base. Gaining an in-depth understanding of why and how countervailing duties exist is a good start. Navigating the agencies that control countervailing duties isn’t always easy, so you may find yourself lost in the fine print.

How to Calculate the Duty on the Value that Includes Freight

Duties and taxes are levied by Customs in the destination country and the receiver is responsible for paying them. © Taxmanagementindia.com [A unit of MS Knowledge Processing Pvt. It is also clarified that value for calculation of IGST as well as Compensation Cess shall also include Anti-Dumping Duty amount and Safeguard duty amount. Dumping is an action taken by other countries when a product from that country is selling so cheaply that it can be imported in mass quantities. In other words, the market is getting dumped on or flooded by a product.

Should You Invest In Crypto? – Forbes Advisor Australia – Forbes

Should You Invest In Crypto? – Forbes Advisor Australia.

Posted: Fri, 23 Jun 2023 07:00:00 GMT [source]

When we mention government financial assistance, we’re talking about subsidies. Within the field of international trade, a subsidy is a monetary benefit granted by the government to businesses and manufacturers. See how foreign subsidies create a need for countervailing measures and how they affect imports. We are importing a Machine form Dubai, UAE country to Chennai.

As an example, let’s use the 4.94% charged for standard exports. As mentioned, a subsidy will only result in countervailing measures if the DOC and ITC investigations both find evidence of current or potential economic harm. Indirect subsidies, although not granted as payments, have the same goal. Instead of just paying the button factory, they may take a related action to save the industry money.

To calculate Assessable Value and Estimated Landed Cost

If you opt for transaction value of your unit container as final price, 6.18% of such value would be the rate of duty. Calculating your own estimate is fine but it is just an estimate. For the final amount of duty owed, it’s best to work with a Customs Broker who can check with ongoing reviews and investigations. Obviously, the greater the product value, the greater the duty. The product value would be what you paid for the products in the exporting country, not what you sell them for in the U.S. If you know the percentage of CVD and the value of what you are importing, you can calculate an estimate of your CVD payment.

This is a considerable amount of information, but by itself, it still won’t result in countervailing measures. At most, this information is used by the DOC to set the provisional measure collected by the CBP as a deposit while the investigation is ongoing. With any subsidy, it’s still the responsibility of the industry to take full advantage of it. Governments might place conditions on subsidies to make sure funds are being used correctly.

- As a consumer-driven economy, our tariff and trade practices make it easy for foreign economies to benefit.

- Subsidies and countervailing measures aren’t the most exciting aspects of importing, but it is necessary to understand them.

- If you look at the above scenarios, we have to pay for multiple parties against a Single Goods Receipt note, but different amounts.

- With any subsidy, it’s still the responsibility of the industry to take full advantage of it.

- Customers are happy, but businesses selling a similar domestic product will have a tough time demanding high prices.

It replaces the preliminary fees set by the DOC during the investigation. Logistics Import Export or freight forwarding process involves a number of customs procedures and requirements. The amount of import duty, tax or levy that must be paid on goods being imported into the country or being exported from the country is called assessable value. An export subsidy can easily create a situation that makes dumping possible.

The DOC and ITC investigative processes are there to make sure of that. The U.S. is also a member of the World Trade Organization (WTO), which has guidelines meant to prevent the indiscriminate application of CVD orders. An example of this are automobiles that are imported into Canada from the United States.

Countervailing duty calculations start by trying to find the exact price difference made possible with the government’s financial aid. This financial help can bring down the cost of production so that large-scale exporting is possible. Once in the U.S., sale prices are well below what domestic producers can achieve. Revenues made from import tariffs fund various organizations and services within the United States. As a consumer-driven economy, our tariff and trade practices make it easy for foreign economies to benefit.